The Impact of US Import Tariffs on Luxury Watches: A Look Ahead

Beginning in April 2025, Swiss luxury timepiece makers will have to cope with a new wave of tariffs from the U.S. government. The initial phase, introduced by the White House, raised import taxes on the kinds of goods hit the hardest by the U.S.-China trade war. For the record, those luxury Swiss watches are not going to be cheap anymore, with some estimates putting the price hike as high as 41 percent by the time we reach summer 2025 (Tariffs in the second Trump administration).

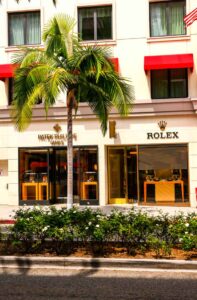

This move will compel retailers to either transfer the cost to consumers or take the hit themselves. Watch sales in the U.S. have already topped out and are in decline; this year’s price increases may very well drive consumers to seek their next luxury timepiece across international borders.

Even as US cities like New York and Los Angeles remain bastions of luxury watch retailing, the potentially looming tariffs may be causing a shift in consumer behavior that could help redefine the global top 10 list of watch shopping cities in favor of places like Hong Kong, Singapore, and Paris.

Right now, there’s an appearance that US e-commerce is insulated from impending tariffs, as watch imports sold over the web primarily go direct from the manufacturer to the consumer, and thus avoid customs duties. But this favorable current may not last long. And if it doesn’t, look for even steeper price increases across an already pricey category.

Rising Costs and State-Specific Taxes: The Retail Landscape in the US

In the US, the luxury watch shopping business has been doing very well. Since 2021, it has grown more than 30%. The best watch boutiques in the US can be found in the main luxury shopping areas of cities like Los Angeles, Miami, and New York. These three cities, together with fancy watch retail, have become a nearly thriving operation. The same goes for the watch secondary market—these three cities are where that is happening, too.

The variation in sales taxes across the country is dramatic. For instance, combined state and local taxes amount to 8.875% in New York, while over in California, shoppers are paying a minimum of 9.75%. These taxes can and do raise the cost of certain items, with luxury watches being a prime example. That makes the U.S. tax landscape one of the critical factors to consider when deciding where in the world to shop.

Apart from making them more expensive, what high taxes do is drive foreign buyers away. They also have an impact right at home, too, of course, since they can make international tourists and affluent Americans less likely to buy the high-end, luxury items that luxury watch companies produce. Imagine going on vacation to a country where almost every good is taxed heavily and where the sales associates are required to inform you that, yes, the watch you’re about to purchase is about to add—you guessed it—another 10% to your final bill.

Tax Policies in China and Their Effect on Luxury Watch Consumption

China has long been a key player in the global luxury watch market, and it is the government that has had most say in shaping all this. Go back to the 1990s, and you find China imposing luxury taxes in an effort to get its citizens to curb their spending on what we now call ‘non-essential’ goods. By 2016, the taxes had gotten so high that some categories of goods were facing duties of 60 percent and that didn’t include the standard 17 percent VAT on imported goods or the 20 percent consumption tax that also at the time was being levied on eligible products—a cumulative tax rate of 97 percent over the manufacturer’s suggested retail price (An Overview of PRC Tax System and Administration).

With such staggering charges, many Chinese consumers have gone abroad to do their shopping. This in turn has caused another phenomenon to crop up, called “daigou.” In the same way that Mount Everest attracts climbers from all over the world, China’s demand for luxury goods has created a kind of gravitational pull on our economy. That’s why our country’s shopping malls, along with those in cities like Hong Kong and Singapore, are filled with so many Chinese tourists.

Moreover, the increasing luxury tax in China has driven cross-border shopping to new levels, particularly in Malaysian and Singapore tax-free zones, where income taxes are a fraction of what they are in China. These trends are also benefiting Hong Kong, another Chinese Special Administrative Region (SAR), which boasts a shop-’til-you-drop atmosphere similar to that of Singapore.

Europe: The Eternal Watch Shopping Destination Despite Rising Risks

Europe is still the central place for buying luxury timepieces, with Paris, Milan, and Geneva offering the top shop destinations for serious watch collectors. France’s luxury watch market is projected to hit 25.61 billion dollars by 2025, not far behind Italy’s, and those two countries—in addition to a few northern European nations—account for the bulk of profit in the whole luxury watch game. Tourists have long been our best customers, with the VAT refunds that they can gain in France and Italy (up to 12 percent) serving as a potent incentive for buying watches in those countries.

Yet, the burgeoning street crime in some of Europe’s most prominent cities has given rise to a slew of new problems. Shoppers who are plumping for high-priced loot these days are just a bit more on the ball, forking over to retailers who seem to have upped their security and are now safeguarding their wares—like the €400,000 Richard Mille watch that originally appeared on an influencer’s Instagram, top of the pop, 24K-style, hammer-and-anvil sorta way.

Even with these difficulties, Europe continues to be an attractive luxury destination. Tourists from around the world still flock to its cities to experience their distinctive architecture and culture and to shop for the very best in international luxury goods. This “retail tourism” is what keeps even the most beleaguered European economies afloat. A major advantage that European destinations have over those in the US is that many cities offer significant VAT refunds, making the overall shopping experience more competitive.

The Changing Dynamics of Luxury Watch Shopping in Tokyo and Asia

Tokyo has become one of the top cities in the world for shoppers looking for luxury timepieces. The city has some of the grandest of the watch world’s monobrand stores and an incredible selection of both new and vintage watches. Japanese consumers have long been some of the best customers for high-end watches; in recent years, however, their shopping has been supplemented—and in some cases, even outstripped—by that of foreign tourists who have come to take advantage of the weak yen.

With Japanese demand on the upswing, Tokyo is the second-largest market for Swiss watch exports. And, on top of that, the really high-end retail environment in Japan, especially in places like Ginza, has given the Tokyo watch market real cachet. Tourists are also a big driver of the Tokyo watch market, with both exclusive Japanese watch models and pre-owned Swiss watches seemingly gaining in popularity.

Japan’s distinctive tax system—under which tourists can obtain a VAT refund at the airport—has made it, historically, an attractive place for luxury shopping in Tokyo. This will not be the case after November 2026, when tourists will need to go through a more involved process to receive their tax refunds accompanying the purchases they made while visiting. This is a definite shift from a super-simple tax refund process that involved little more than stopping at the airport VAT refund window.

Singapore’s Status as a Leading Watch Shopping Destination in Asia

Singapore is consistently ranked among the top six global destinations for Swiss watch exports, which is making the city-state a hub for Asia’s luxury timepiece retail. In Singapore, there is a high level of retail sophistication that is combined with a super favorable tax environment, which means it is a prime place for both local buyers and international tourists to pick up purchases of the watch kind. All of this means major Asian buying power with the watch kinds—not to mention the drawing power that the city-state has, to watch buyers from not just around Asia but around the whole wide world.

The ideal setting for consumers to wear and buy high-end watches is the place where crime is low and safety is a hallmark. These conditions make Singapore a comfortable marketplace for luxury watch consumption. With its relatively low crime rate and general reputation for safety, Singapore has the ambiance of an ideal market for international luxury consumables—watchmaking including timepieces both mainstream and niche.

The retail landscape in Singapore has undergone a transformation lately, with demand from local shoppers on the upswing. As the world pandemic tapers off, the city-state once again finds itself a tourism magnet, with foreigners eager to visit largely because of the favorable exchange rate. Among the sights that these travelers can enjoy are found an extensive assortment of luxury timepieces that place Singapore on the must-visit list for tax-friendly, world-class watch shopping.

Dubai’s Growing Influence in the Luxury Watch Market

A global leader in the luxury retail space, Dubai has solidified its status—particularly when it comes to timepieces. Thanks to a nearly nonexistent value-added tax and a tax-friendly retail environment, the Emirate has carved out a pricing sweet spot for high-end horology. And with watch retail extending from its opulent shopping malls to the lobbies of the city’s iconic luxury hotels, the perfect atmosphere for such upscale experiences is everywhere.

The culture of horological appreciation in the UAE has been greatly assisted by the existence of well-known retailers such as Ahmed Seddiqi & Sons. The UAE, and particularly Dubai, has in turn taken great strides toward becoming a global watch destination, thanks in no small part to the presence of said retailers and the holding of events like Dubai Watch Week.

Furthermore, the safety and cultural acceptance of luxury buying in Dubai render it a perfect place for watch enthusiasts to indulge in their predilection for the timepieces—without fear of theft or judgment. Not only does this Middle Eastern city have all the makings of an ideal retail environment, but its competitive pricing and exceptional service keep drawing the kinds of people from around the world who can help sustain its ever-spiraling, elite-level watch business.

Frequently Asked Questions (FAQ)

- What will be the impact of the new tariffs on Swiss watches for consumers in the US?

The 10% import tax is already here, and a 31% tax is lined up next. So it will be a lot more expensive to buy luxury Swiss watches in the US. We might feel that when we walk into a store to buy a luxury Swiss watch and see the retail prices not just up but up significantly. - Tax refund options for international buyers in the U.S.?

Sadly, the vast majority of states in the US do not refund VAT or sales tax to foreign visitors. This puts US luxury retailers at a disadvantage because purchases made here are more expensive than in countries, such as France or Italy, where very substantial refunds can be obtained. - Why do countless Chinese customers purchase high-end timepieces overseas?

China has implemented significant luxury taxes, such as the VAT and consumption tax, that can total 97% of the product price. Consequently, many Chinese consumers opt to purchase luxury goods, including watches, from foreign markets to sidestep these substantial tariffs. - What are the benefits of purchasing high-end timepieces in Dubai?

Fans of high-end watches have found Dubai an increasingly attractive place to make their purchases and for several reasons. The first is that they can be lured by Dubai’s tax-friendly environment and by what some perceive to be the implanting of the Middle Eastern version of a watch-buying “service elite”—for lack of a better term—in the city. Not only is the VAT in Dubai minimal (5 percent), but almost nothing that you might think would be subject to taxation is because taxes on a whole host of goods have just kind of disappeared in this tax haven. So, it’s very easy for us to work in, very easy for you as the Watch Lover to work in, and for the Service Elite to work in, when almost everything is service and thanks in this watch-buying playground. - In what ways is the luxury watch market changing in Asia?

Asia, especially Japan and Singapore, remains a powerful bastion for the purchasing of luxury timepieces. Both nations have carved out a space as go-to enclaves for high-end horology, and for several good reasons: their retail scenes are nothing short of amazing; their tax policies are watch-friendly; and the modes of exclusive timepieces that allure worldwide watch enthusiasts are, on the whole, better seen and more often experienced in these two countries than anywhere else.